In this post, explore flexible payment options that make dental care affordable, from insurance help to membership plans and financing solutions.

Your Guide to Dental Insurance Open Enrollment

Fall doesn’t just bring cooler weather—it’s also open enrollment season for many dental insurance plans. Whether you’re reviewing coverage through your employer or exploring options on your own, this is the time to make changes that can impact your dental care for the next year. At CarolinasDentist, with 15 convenient locations across North Carolina, we want to help you feel confident navigating your dental insurance choices so you can make the most of your benefits.

What Is Open Enrollment?

Open enrollment is the window—usually in the fall—when you can sign up for, change, or renew your dental insurance plan. Outside of this period, most people can only make changes if they experience a qualifying life event, like marriage, a new job, or a move.

If you’ve ever glanced at your dental coverage options and felt overwhelmed by the terms or fine print, you’re not alone. This is the perfect time to review what your plan actually covers and make sure it still fits your needs.

Understanding Different Types of Dental Plans

When comparing coverage options, you’ll often see terms like PPO, HMO, or dental discount plan—and knowing the difference can make choosing a plan much easier.

PPO (Preferred Provider Organization): These plans are the most flexible. You can visit any dentist you’d like, though staying in-network (like at CarolinasDentist) usually means lower costs. PPOs are a great choice if you value choice and don’t mind slightly higher premiums for that flexibility. CarolinasDentist is a preferred provider for most dental insurance plans, including: Blue Cross Blue Shield, Cigna, Delta Dental, and MetLife.

HMO (Health Maintenance Organization): These plans typically have a more limited network of participating dentists and require you to choose one main provider. They often have lower monthly costs, but they’re best suited for patients who plan to stay with one office long-term and don’t need out-of-network options.

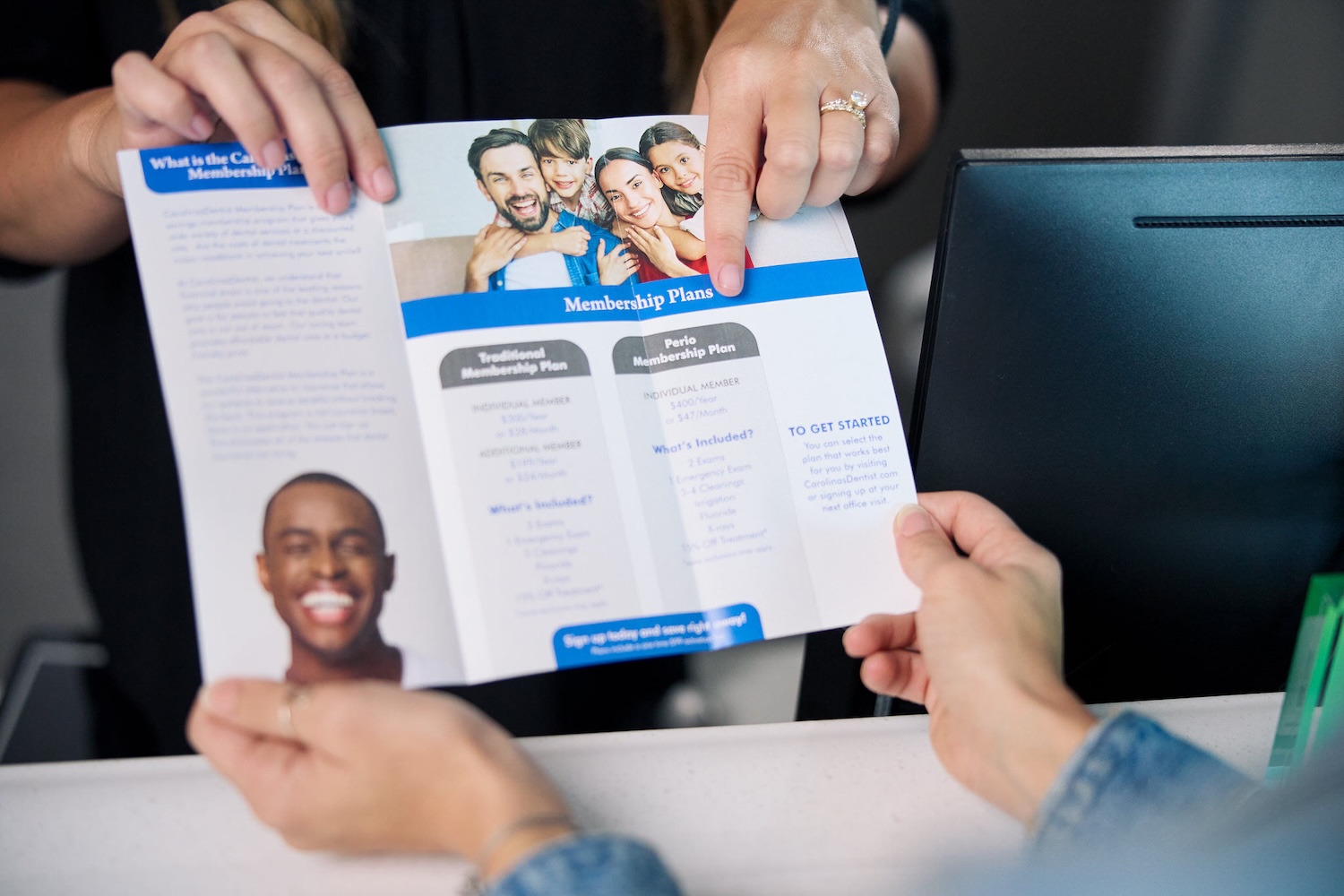

Dental Discount Plans: These aren’t insurance but can still provide significant savings on cleanings, exams, and treatments. Discount plans offer straightforward discounts without waiting periods, deductibles, or claim forms—perfect for those without traditional dental insurance.

The right plan for you depends on your dental needs, how often you visit the dentist, and how much flexibility you want in choosing where to go.

Why Dental Coverage Matters

Dental insurance works a bit differently than medical insurance. Instead of covering emergencies first, most dental plans focus on prevention—think cleanings, exams, and X-rays. Those services are often covered at 100%, which makes regular visits easier and more affordable.

Maintaining your coverage ensures you can keep up with preventive visits and catch problems early—before they become painful or expensive. It’s also a great opportunity to plan for bigger treatments, like fillings, crowns, or orthodontics, that might be partly covered under your plan.

Key Terms to Review During Open Enrollment

A quick refresher can make comparing plans easier. As you look at your options, pay attention to:

- Annual maximum: The total your plan will pay for dental care each year.

- Deductible: The amount you pay out of pocket before your coverage kicks in.

- Coinsurance: The percentage of costs you’re responsible for after meeting your deductible.

- Waiting periods: Some plans have a short waiting period before covering certain procedures.

- In-network providers: Sticking with in-network dentists—like CarolinasDentist—usually means lower out-of-pocket costs.

Knowing these details ahead of time helps you choose a plan that matches your dental goals and budget.

How to Make the Most of Your Dental Benefits

Once you’ve selected your plan, be sure to use your benefits before they reset. Most dental insurance benefits renew annually, which means unused cleanings or coverage dollars don’t roll over to the next year. Scheduling your routine checkups early can help you maximize your coverage and prevent year-end rushes for appointments.

If you’re planning for larger treatments—like crowns, implants, or orthodontics—your CarolinasDentist team can also help you coordinate timing to make the best use of your benefits across plan years.

We’re Here to Help at CarolinasDentist

Insurance terms can be confusing, but you don’t have to figure them out alone. Our team at CarolinasDentist is happy to review your benefits, explain what’s covered, and help you get the most value from your plan. Whether you’re renewing your existing coverage or shopping for a new one, we’ll make sure your dental care stays smooth, affordable, and stress-free.

If you have questions about insurance open enrollment—or if it’s time to schedule your next checkup—contact your nearest CarolinasDentist location in North Carolina. We’re here to help you keep your smile healthy all year long.